Trump urges Powell to make a larger Fed rate cut ahead of the FOMC meeting, with expectations for a 25 bps reduction and market impact.

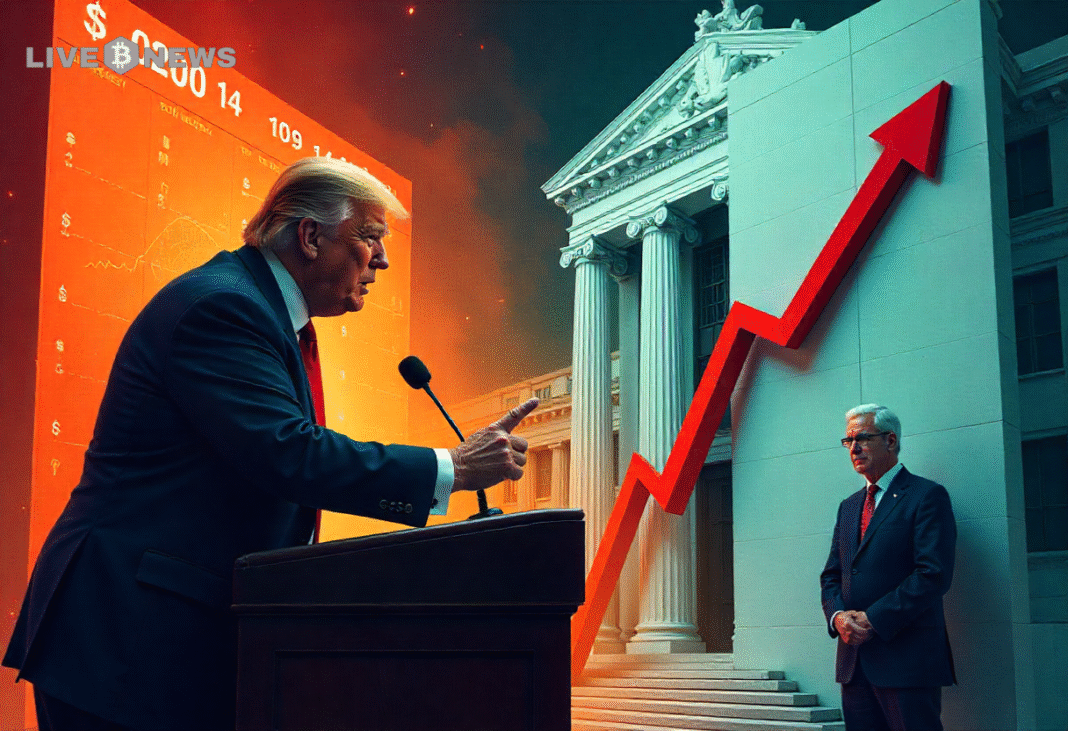

Ahead of the upcoming Federal Open Market Committee (FOMC) meeting, U.S. President Donald Trump has called for a larger Federal Reserve rate cut.

Trump’s call to Jerome Powell is in response to the anticipated 25 basis points (bps) cut, urging Powell to make a more aggressive reduction. This request comes as the market watches for decisions that could influence both the economy and cryptocurrency markets.

Trump’s Push for a Larger Rate Cut

President Trump voiced his request on Truth Social, emphasizing that the Fed must cut interest rates more than initially planned. He stated, “Too late,” referring to Powell’s current rate-cut plans, urging a larger reduction.

This statement follows Trump’s ongoing calls for a 100 bps cut, a view he has maintained for much of the year. He believes the Federal Reserve should have already lowered rates by 300 bps since he took office.

Trump’s repeated calls reflect his frustration with the current economic conditions and his belief that lower rates could help stimulate growth. However, the Fed has so far been cautious, with economists predicting only a 25 bps cut at this week’s FOMC meeting. CME FedWatch data shows a 94.2% chance of a 25 bps rate cut, with a smaller likelihood of a 50 bps cut.

Economic Data and the Debate Over the Cut Size

The debate over the magnitude of the rate cut is intensifying, especially after recent economic data.

August’s inflation rate rose to 2.9%, which, while in line with expectations, has raised concerns about rising inflation. At the same time, a softening labor market suggests that further rate cuts might be necessary.

Former Federal Reserve Vice Chairman Roger Ferguson weighed in on the situation. He argued that a 25 bps rate cut is more appropriate than a larger reduction. He cited the challenges the Fed faces in taming inflation, as the 2% target remains out of reach.

Despite weak labor data, Ferguson suggested the Fed would likely take a more measured approach and avoid a 50 bps cut.

Potential Effect on the Crypto Market

Many analysts believe that a Fed rate cut, regardless of its size, could be bullish for the cryptocurrency market.

BitMEX co-founder Arthur Hayes has predicted that a more aggressive rate-cutting cycle could help extend Bitcoin’s bull cycle. If the Fed cuts rates more significantly, it could lead to increased liquidity in markets, potentially benefiting digital assets like Bitcoin and other cryptocurrencies.

While Trump’s push for a larger cuts has not been successful thus far, the debate continues to shape market expectations. With the Fed’s decision looming, the outcome could have widespread effects on both traditional and crypto markets.