Ethereum price faces a TD Sequential sell alert near resistance while bulls aim for a potential $7,500 breakout.

Ethereum is at a decisive point on the charts as technical indicators show mixed signals. The TD Sequential indicator has issued a sell signal near a key resistance zone, suggesting a potential short-term pause. At the same time, market analysts and traders remain divided on whether Ethereum can sustain its upward momentum and break toward higher targets.

Mixed Technical Outlook Near Key Resistance

Crypto analyst Ali Martinez noted that Ethereum’s price is flashing a TD Sequential sell signal as it tests an important resistance level. According Ali, rejection from this zone could send ETH toward $4,100 or even $3,780. This signal appears as Ethereum consolidates above $4,500 after a strong recovery from recent lows.

Meanwhile, Ethereum has been holding above its 100-hour simple moving average, indicating continued buying support. Recent data shows that the $4,500 level has become a key support area, while the next resistance stands around $4,620. If Ethereum manages to stay above this range, analysts suggest the next major test could occur near $4,775.

Technical indicators remain mixed. The Moving Average Convergence Divergence (MACD) shows bullish momentum, while traders remain cautious of a potential pullback if selling pressure rises. Ethereum’s price structure indicates that maintaining support above $4,480 will be crucial for the continuation of the current trend.

Bullish Traders Target a Ethereum $7,500 Breakout

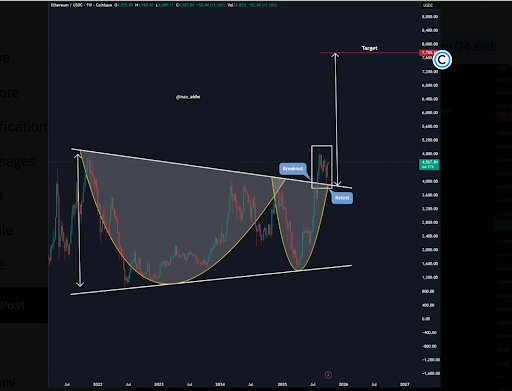

Market analyst Cas Abbe presented a more optimistic view, describing Ethereum as one of the strongest charts in the market. Abbé pointed out that Ethereum has achieved a clean breakout, retested previous resistance as support, and is now positioned for a potential move toward $7,500 by the end of the fourth quarter.

Recent data supports the bullish case. Ethereum has recorded consistent gains alongside Bitcoin, climbing more than 5% in the past few sessions. The price briefly touched $4,616 before consolidating, with the hourly RSI staying above 50, signaling sustained buying momentum.

For the bullish scenario to hold, Ethereum must close above $4,620 and then push through $4,650. A successful breakout above these levels could open the way for a move toward $4,800 and eventually $5,000. If the rally continues, the long-term breakout target projected by traders stands around $7,500. However, any failure to sustain above the current range may trigger a short-term correction toward $4,350 or lower.

Market Behavior and Broader Sentiment

Despite strong price action, Ethereum’s market remains influenced by investor behavior and broader sentiment. Data from Glassnode indicates that nearly 97% of Ethereum addresses are in profit. Historically, this level has preceded profit-taking phases that led to temporary corrections. Yet, many holders appear to be holding their positions, suggesting that selling pressure could remain contained.

At the same time, concerns have emerged around the influence of retail investment in Ethereum treasury companies, particularly in South Korea. Reports suggest that nearly $6 billion of retail capital has flowed into these firms, raising questions about sustainability. Bitcoin advocate Samson Mow warned that these positions may be supported by speculative enthusiasm rather than long-term fundamentals.

The only thing keeping ETH at these levels is the Korean retail investor, specifically the seohak gaemie (서학개미). There’s around $6 billion dollars (dollars, not KRW) of Korean retail capital propping up the Ethereum treasury companies.

ETH influencers have been flying to… https://t.co/ezc2cGtQhx

— Samson Mow (@Excellion) October 5, 2025

Despite such warnings, Ethereum’s macro outlook remains constructive. As long as the cryptocurrency maintains support above $4,500 and continues attracting inflows, traders expect attempts to retest higher resistance levels. Ethereum’s ability to hold its current momentum will determine whether it can extend its gains toward $5,000 and beyond in the months ahead.